Today I'm satisfied with my results....3 trades (1 real-winner)

Expectation:

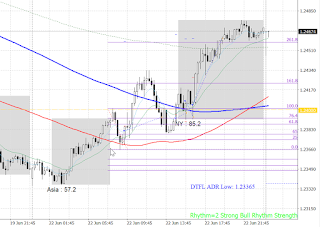

Last Friday we saw a second push down. From that perspective we could expect a third push down.

Setup 1:

After the Asian-session price retraced to the sma89...did broke it and was already halve-way the ranging area. At 10:00 we see a dark cloud cover formation. The entry-candle also traced for more then 25%.

TP: just above high of this formation

SL: retracement formation, sma89 or even further if no retracement formation is developing.

This trade was in potential around the 54pips

-------------------------------------------------------

Well I saw the retracement and at that moment I wanted to stick to the market-rhythm rule if in ranging area then price. Be careful it can b a rough right. But in this case I did not realized that we had some positive points for a bearish setup!

1) we expect a down-move

2) we have a strong dark-cloud cover

3) it's the second try for reversing

That together is making this trade very valid.....

Unfortunately I saw realized it 30min to late...which made me in a mode for getting those "lost" pips....

I know a bad habit...and I try to work on it....see my last post. Anyway if you see my next trading I did stick to the strategy..but did not followed the Plan that well.... A point to work on!!

-------------------------

A terrible setup here I did not really followed the plan....

around 13:00/13:30 I see again a dark-cloud cover, just broke the sm8...and hope it would work. ell just a retracement around the sma8 doesn't say anything.... and yes it wasn't a right one... market went a little higher for producing the next dark-cloud cover.... also not ready for a trade. Anyway I noticed it...and moved myself back to the plan and closed the trade....

a lost of -9pips....

-------------------------------------------------------

learning i difficult.... after I closed my last trade with a lost.... Price is reversing and yes again I'm trapped.... not following the plan.

I let the trade run because I hope price is reversing...yes a little but then it is around my opening price. So I decided to close the trade with a small small win

a win of 3pips....

-------------------------------------------------------

Setup2:

Then price retraced towards the 21sma and retraced....finally a setup

I started the tray a little to early....but price indeed reversed and finally I could make some pips

SL just above engulfing pattern

TP retracement candle, 161,8fib level, ADR-level

Finally this trade made me 60pips

-------------------------------------------------------

Actually also this setup is not a real trade because the entry-candle did not retraced by 25%

Setup3:

Then there is around 16:30 again a setup. Price reached sma21 and retraced with an engulfing formation. also here the entry candle did not retraced for 25%

So actually we have 3 setups here....and only the first on was following my plan/strategy worth a trade

Maybe setup2 and 3 were both real trades but only because of the bearish pressure and engulfing candles......

At the end I'm satisfied today. Just because I noticed that I did not follow the plan...and at the end I also closed trades if they went into the wrong direction...instead of only hoping!

I learned something today ;)